First there was the rise of Japanese manufacturers in the ‘80s, then there was the rise of Korean manufacturers in the early ‘00s, now Australians are looking down the barrel of a fresh onslaught of new and reborn car marques out of a seemingly unstoppable China.

China’s automotive industry has experienced an unprecedented boom over the last 10 years, churning out an increasing number of cars at breakneck pace.

While most of this progress has benefited from favourable government policies to keep Chinese car buyers purchasing domestic rather than imported product, that hasn’t stopped the country’s largest auto groups from setting their sights on more ambitious export targets – like the notoriously competitive and difficult battleground here in Australia.

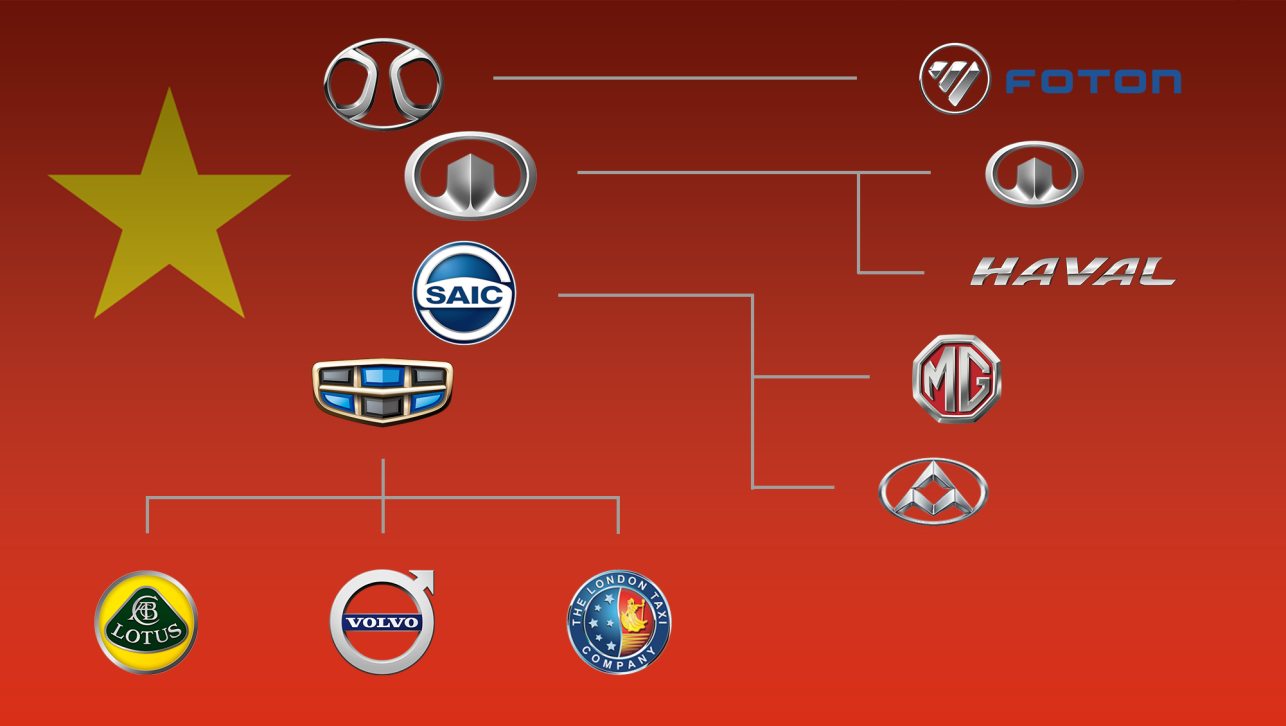

You’ve probably heard that some notable marques from the past, like MG, are now Chinese made cars, so we’re going to break down the big players by auto group, and which vehicles on the Australian market in 2019 and 2020 are owned and produced by Chinese car companies.

Geely Auto

.jpg)

Never heard of Geely? Understandable, the brand doesn’t market its own name or its Chinese-market brands in Australia, but Geely is one of the most wealthy and powerful auto conglomerates in China.

Geely now owns car brands you definitely will be familiar with that are still sold in Australia, including Volvo, Lotus, The London Taxi Company (now the London EV Company), and Proton. Geely also owns an all-new marque that has its eyes set on Australia (eventually) called Lynk & Co which uses Volvo chassis and technology.

While the brand has no plans to expand on its already formidable catalogue of nameplates, it has many emerging and electrified nameplates – like Geometry – which could one day make it to Australian shores.

Like the Indian conglomerate Tata (which owns Jaguar Land Rover), Geely has a history of not interfering with its western subsidiaries’ design and development, resulting in a seamless lineage of products which make its foreign ownership imperceptible to buyers.

To that end, Volvos are predominantly designed and developed in their home market of Sweden, and built on European production lines.

SAIC Motor

.jpg)

SAIC Motor (formerly Shanghai Automotive Industry Corporation) has been one of the most aggressive Chinese operators in Australia, flexing its corporate muscle in the last decade or so to acquire once-struggling European brands like MG (formerly Morris Garages) and LDV (formerly Leyland DAF Vans).

It relaunched both brands to the Australian market, using the MG Motor marque for passenger cars and LDV for commercial vehicles (the latter distributed by Ateco Group). Despite early struggles, SAIC is now achieving relative success off the back of an affordable and improving product line-up in important segments with long warranties.

Unlike its Geely rival – SAIC only partially designs its Australian-market cars outside of China and builds them on Chinese production lines.

Great Wall Motors

.jpg)

Great Wall is also one of the largest auto groups in China, but unlike SAIC or Geely – it has not purchased western brand names for its products.

Instead Great Wall has made slow but steady progress in Australia with its simple and affordable Chinese dual-cab utes, like the Steed, as well as its Haval SUV sub-brand.

The brand has big plans for expanding its right-hand-drive export offering, with a slew of new products under both the Great Wall and Haval banners on the horizon. The brand also markets luxury SUVs under the Wey marque in China and has an entirely electric city car sub-brand called Ora, neither of which are set for an Australian launch any time soon.

Are Great Wall cars any good? They may be behind established rivals in terms of refinement and specification, but anecdotally, commenters tell us they have been happy with their trucks.

At present Great Wall’s vehicles are designed in and sourced from facilities in China, however this could change with the Chinese giant’s purchase of General Motors’ Thai factory which used to produce the Holden Colorado.

BAIC

.jpg)

BAIC (Beijing Automotive Industry Holding Corporation) is notable for Australians as the parent company of a slightly more recognisable brand: Foton.

Primarily known for its Tunland dual-cab pick-up, Foton is a commercial vehicle manufacturer which also sells the Aumark light and medium duty trucks in Australia.

While it might not have the relative traction of its Chinese counterparts, Foton has managed to stick around in a highly competitive market segment since 2012.

Dongfeng Motor

.jpg)

Dongfeng is not a brand you’ve likely heard of, as its involvement with the global automotive scene is largely one of joint ventures enabling Japanese and European automakers to gain a foothold in the Chinese market.

However, cars manufactured by the Chinese giant could be hitting Australian streets rather soon, as Australian start-up company EV Automotive has struck a deal to secure small volumes of right-hand-drive examples of the brand’s electric line-up.

Eventually wearing EV Automotive branding, the Dongfeng Glory E3 mid-size electric SUV is scheduled to hit Australian streets this year. It offers a competitive 405km range and is targeting a “mid-sixty-grand” pricetag. The E3 will shortly be followed by a van and EV Automotive will not use a dealer model, instead hoping to sell directly to customers via an online portal.

Chery

.jpg)

You might remember Chery for its brief and not very memorable blip on the Australian new-car market between 2011 and 2014. During that time, the cars from the Chinese state-owned enterprise had sold poorly in part due to dated designs and lacklustre safety performance.

Since then the brand has overhauled its range in China to offer a much more contemporary line-up of SUVs and sedans, and while the occasional Chery vehicle has been spotted Down Under, it is said to be for testing purposes only as the Chinese brand remains focused on left-hand-drive markets for the time being.

Yutong Bus

.jpg)

A minor one for car buyers, but one which operates in Australia that you may have seen on the streets, Yutong is a commercial vehicle manufacturer which specialises in buses. The Chinese company claims it has a 15 per cent global market share of the bus industry and competes in Australia with established players Toyota, Fuso (Mitsubishi), Mercedes-Benz, and Volvo.

Yutong sees an electrified “new energy” future and already markets multiple fully electric bus options internationally with a view to bringing them to Australia on a larger scale.

Other brands and joint ventures

.jpg)

There is a long list of other Chinese manufacturers that we won’t list here, mainly because they do not offer, or do not plan to offer products in the Australian market. This is generally because these brands are for domestic Chinese consumption only, targeted at both the Chinese market and export to developing markets, or are generally focused only on left-hand-drive markets.

Some of the larger and more powerful corporate groups like Chang’an, FAW (First Auto Works), and GAC (Guangzhou Automobile Group Co) which do not sell products in Australia are notable because they also have joint ventures with many of the world’s largest auto manufacturers.

Joint ventures are required for large international companies to do business in China. The laws stipulate that foreign corporations wanting to establish a base in China must pair with an existing local company to do so.

While these manufacturers gain access to one of the world’s top three economies and benefit from local knowledge, the US government considers joint ventures a mechanism for forced technology transfer, putting what would otherwise be commercially exclusive or sensitive information in the hands of Chinese companies, and inevitably its government. The spat over joint ventures are a major part of the US-China “trade war”.

Tesla is the only brand notably exempt from these rules, after the brand struck a one-of-a-kind deal with the Chinese government to build a factory in a free-trade zone in Shanghai. Up until that point Tesla was reportedly selling up to US$1 billion worth of cars to the Chinese market.

The rise of joint ventures in the last decade has had the side-effect of causing a massive reduction in the number of Chinese copycat cars from the largest auto groups, as well as an increase in reliability and safety as more brands adopt unique designs to work with instead of against their newfound western partners.

Notable joint venture partners building cars in China include Volkswagen, BMW, Daimler, General Motors, Fiat Chrysler Automobiles and Groupe PSA (Peugeot and Citroen).

Chinese electric cars

.jpg)

While it’s unlikely we’ll see many Chinese sports cars or Chinese luxury cars sold in Australia in the near future, a much more likely prospect is the emergence of more affordable Chinese electric cars.

Due to the Chinese government’s “New Energy Vehicle” mandate, a plan to boost sales of electric vehicles to 4.6 million units by 2020 with a view to eventually banning combustion vehicle sales, Chinese automakers must comply with quotas (10 – 12 per cent) of the number of EVs they sell in order to win credits.

These targets have caused an explosion in the number of electric vehicles being sold and developed in China. The first notable Chinese electric car to hit our shores will be the MG eZS – which is set to be Australia’s cheapest mainstream electric car when it goes on sale later in 2020.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

copy.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

_0.jpg)

.jpg)

Comments